Trump Advocates "Beautiful Act" as House Prepares for Vote

- President Trump calls for House action on the "Beautiful Act" following Senate approval, aiming at tax and spending reforms.

- U.S. market confidence may indirectly influence digital asset trends.

- Industry comments focus on crucial air travel and credit union tax provisions.

U.S. President Donald Trump announced on Truth Social that the House of Representatives appears ready to vote on the "Beautiful Act" tonight.

The reform involves tax and sector changes, potentially boosting business sentiment and indirectly affecting cryptocurrencies.

Trump's Tax Agenda: Impacts and Market Reactions

President Donald Trump, alongside Republican leaders, has communicated confidence in the House's readiness to endorse the "Beautiful Act." This initiative, driven forward by Commerce Committee Chairman Ted Cruz and others, marks a decisive step in the administration’s agenda. Actions emphasize modernizing air traffic control and preserving credit union tax exemptions. Efforts by key figures indicate a broad intent to maintain economic stability while advancing infrastructure.

Changes introduced by the bill involve setting a corporate tax rate of 21%, maintaining competitive edges for U.S. businesses. The emphasis on air traffic modernization funds underscores ambitions to keep the U.S. as a leader in aviation. Business sectors, particularly credit unions, perceive tax certainty gains positively, with financial repercussions spanning beyond traditional markets.

According to President Trump, "I urge the House to act swiftly after the Senate’s passage of the One Big Beautiful Bill." Market reactions lean towards optimism, with stakeholders like Jim Nussle expressing gratitude for the bill's provisions. The $12.5 billion allocation to aviation systems has drawn attention from industry voices, such as Jackson Shedelbower, focusing on funding’s potential. The focus remains on swift House passage to cement these anticipated benefits.

Cryptocurrency Movements Amid Economic Sentiments

Did you know? Previous large-scale U.S. tax reforms, like the 2017 Tax Cuts & Jobs Act, led to broad-based equity rallies, hinting at potential spillover effects into BTC and ETH as investor confidence grows.

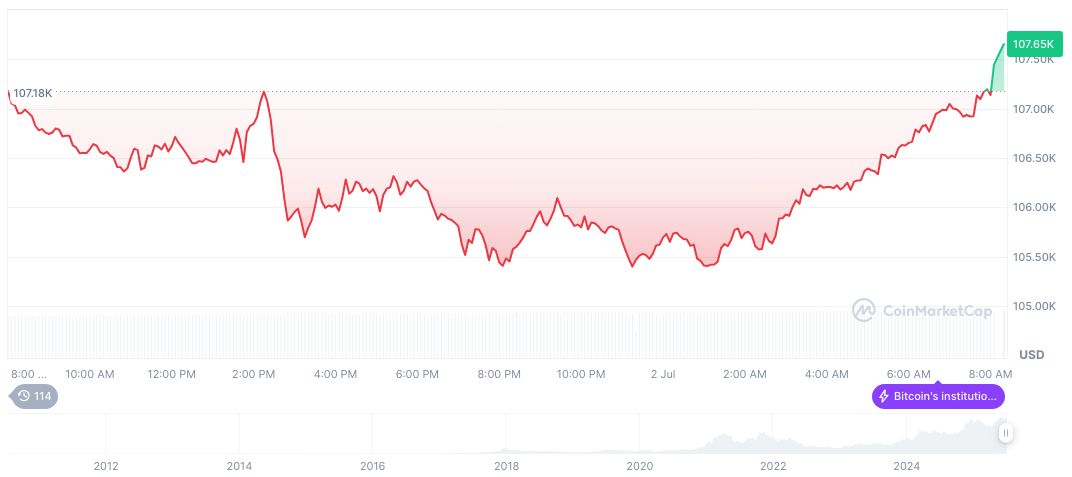

Bitcoin (BTC) experienced a 3.10% rise over the past 24 hours, reflecting market anticipation of fiscal reforms. With its valuation at $109,056.92 and a market cap of $2.17 trillion, Bitcoin’s dominance remains firm, according to CoinMarketCap. Trading volumes approached $56.45 billion within 24 hours, showcasing a 26.55% increase. The cryptocurrency's trajectory over 60 days shows a 13.96% gain, indicating resilience.

Insights from the Coincu research team suggest potential macroeconomic impacts as the reform progresses. Historically, such legislative actions may bolster digital asset sentiment, influenced by fiscal stability. Observations highlight increased confidence in businesses translating to shifts in the digital currency landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |