HashKey Passes HKEX Listing, Plans Digital Asset Expansion

- HashKey gains HKEX listing approval with notable joint sponsors.

- Supporting 80 tokens with HK$19.9 billion assets by 2025.

- The market reacted positively, increasing HashKey's token by 13%.

HashKey Holdings Limited has passed its Hong Kong Stock Exchange listing hearing, planning to create a licensed digital asset ecosystem with support from JPMorgan Chase and other sponsors.

This initiative aims to bolster regulated crypto offerings, potentially impacting broader digital markets and increasing platform assets beyond HK$19.9 billion by 2025.

HashKey's Strategic Moves: Listing and Market Influence

HashKey Holdings Limited has successfully navigated the Hong Kong Stock Exchange's listing procedures, with JPMorgan Chase, Guotai Haitong Securities, and Guotai Junan International as joint sponsors. The company aims to establish a comprehensive digital asset platform. Stakeholders include Gaorong Capital, Fidelity, and Meitu. Lu Weiding is among the major shareholders of the initiative.

This listing marks a significant shift for HashKey, positioning it as a key player in offering on-chain services, transaction facilitation, and asset management. By 2025, it plans to support 80 tokens with over HK$19.9 billion in platform assets. As Lu Weiding, Major Shareholder, HashKey Holdings Limited, said, "Our goal is to establish a fully licensed digital asset ecosystem that will simplify transactions and enhance on-chain services."

The announcement triggered positive market reactions, evidenced by a 13% increase in the value of HashKey's native token (HSK). This response reflects investor confidence in the company's future direction in the digital asset arena.

Investor Optimism: HashKey's Token Rise and Broader Market Trends

Did you know? HashKey's 13% token rise mirrors the prior surge Circle experienced after its Hong Kong IPO, highlighting investor optimism toward regulated digital asset expansions in the region.

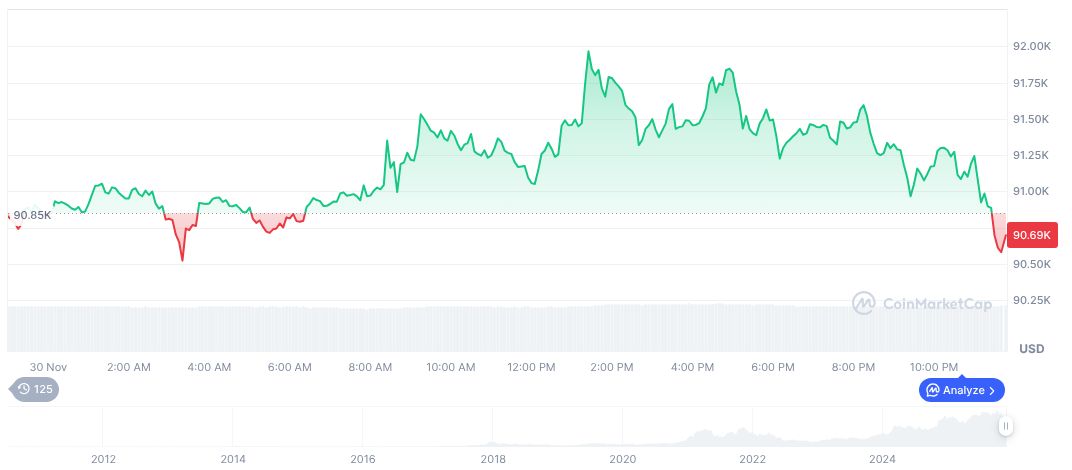

Bitcoin (BTC) is currently priced at $87,470.50 with a market cap of $1.75 trillion and a market dominance of 58.75%, according to CoinMarketCap. In the last 24 hours, BTC has traded approximately $48.37 billion, despite a price drop of 3.87%. The supply stands at nearly 20 million coins.

Analysts from Coincu suggest that HashKey's listing aligns with Hong Kong’s regulatory standards, potentially attracting further institutional interest. Historical trends indicate increasing credibility and investment in licensed crypto platforms may bolster market stability, benefiting HashKey’s ambitious growth agenda.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |